The adult-use marijuana market in Illinois is thriving. Many new cannabis entrepreneurs are in the process of opening cannabis businesses, and there are more opportunities to come for those who want in on the Illinois cannabis industry. In this article, our Illinois cannabis consultants provide all the information you need to win a cannabis license. We’ve won numerous dispensary, craft grow, and infuser licenses in the first rounds of licensing, and now we share with you our secrets to success.

We’ll start with an overview of the laws, types of licenses, and application process. You’ll also find actionable steps you can take now to secure an Illinois cannabis license. But if you’d prefer to speak with our marijuana business consultants in Illinois on the phone, feel free to schedule a free consultation.

Illinois Cannabis Consultants

Laws and Rules

The best place to start is to familiarize yourself with the laws and rules of the Illinois cannabis industry. Thus, our Illinois cannabis consultants suggest familiarizing yourself with the following:

- Notice of Emergency Rules December 9, 2019

- Cannabis Regulation and Tax Act

- CRTA Administrative Code (IDFPR)

- CRTA Administrative Code (Department of Agriculture)

Similarly, you should regularly check the websites of the following agencies that oversee the Illinois cannabis industry:

The above-referenced laws and regulations will provide you with an outline of the application process, license types, eligibility, restrictions, operational requirements, and more. Likewise, the websites are where you will find the latest news regarding Illinois cannabis licenses.

Don’t have time to read thousands of pages of laws? No problem. Our Illinois cannabis business consultants distilled the important information for you and summarized it in this article.

Timeline for Cannabis Business License Applications

Gov. Pritzker recently announced that the IDFPR will accept applications for the Illinois cannabis dispensary license lottery until April 21st, 2023.

As for the craft grow and infuser licenses, it is not clear when the Illinois Department of Agriculture (DOA) will accept applications for new licenses. However, it is stipulated in the laws that the DOA has the authority to issue up to 150 craft grow licenses, and the DOA has only issued 78 craft grow licenses to date.

Types of Illinois Cannabis Business Licenses

There are several types of adult-use cannabis business licenses in Illinois that you can apply for, including:

- Dispensary

- Craft Grow

- Infuser

- Transporter

- Testing Laboratory

You will want to review the authorized conduct of each license type and decide which one fits your business goals.

License Application Process

Each license type will have its own application process. As mentioned above, it is not clear when the next craft grow, and infuser licensing round will be, and the application process could change too.

On the other hand, the dispensary lottery license application is around the corner, and the process is finalized. In short, the lottery license application process has been greatly simplified and reduced, and only basic information is needed to enter the lottery. However, your applying entity must qualify as a Social Equity Business (described in the next section).

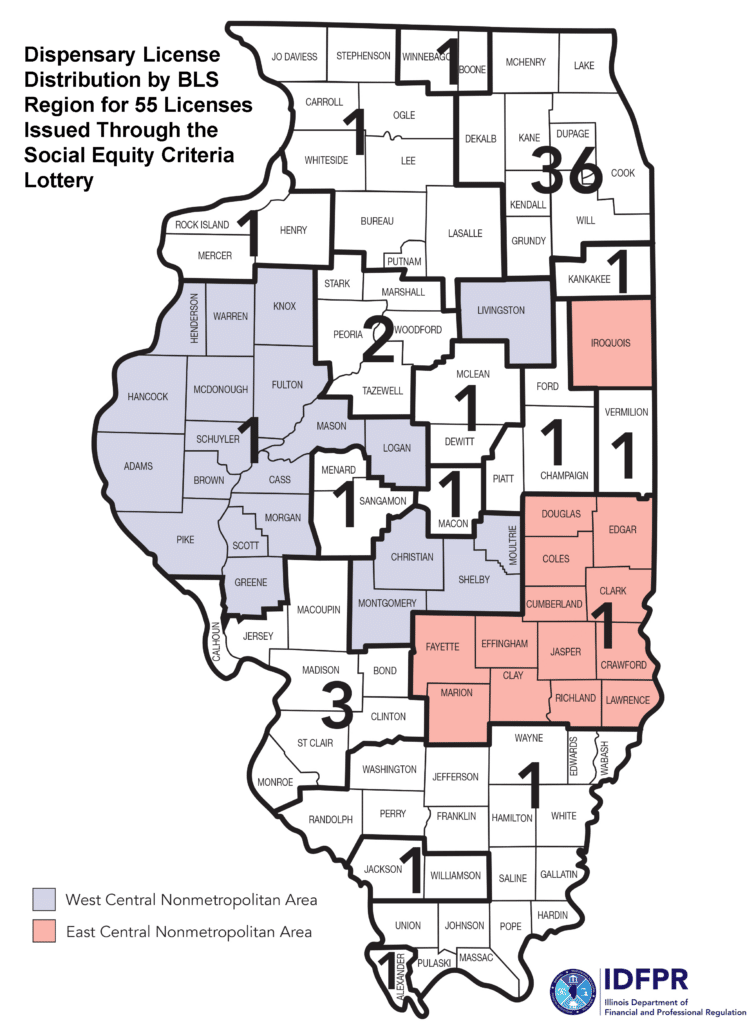

The IDFPR will issue 55 social equity dispensary licenses across 17 BLS districts in Illinois (as shown in the map below). You can only submit one application, so choose wisely.

The first applicant drawn in the lottery in each BLS district will have a chance to prove they meet the social equity criteria. The second applicant drawn will have the second opportunity to a conditional license, and so on.

You will first be issued a conditional license, and then you will have 45 days to prove you are social equity. If you succeed, you will then have 365 days to identify a location for your dispensary within the BLS District.

Social Equity for Illinois Cannabis Businesses

So how do you qualify as a social equity business?

To qualify as a social equity business in Illinois, the business entity must be 51% or more owned or controlled by one or more individuals who each meet the combination of at least one or the criteria under Criteria A and one of the criteria under Criteria B. This does not mean multiple individuals need to meet identical criteria, but each individual must meet at least one criteria from Criteria A and one criteria from Criteria B.

Criteria A (only 1 required):

- An individual who has resided for at least 5 of the preceding 10 years in a census tract that has a poverty rate of at least 20% according to the latest 5-year American Community Survey (Table S1701: Poverty Status in the Past 12 Months);

- An individual who has resided for at least 5 of the preceding 10 years in a census tract where at least 20% of the households receive assistance under the Supplemental Nutrition Assistance Program in the latest 5-year American Community Survey (Table S2201: Food Stamps/Supplemental Nutrition Assistance Program (SNAP));

- An individual who has resided for at least 5 of the preceding 10 years in a census tract area classified as “low income and low access” where at least 100 households are more than one-half mile from the nearest supermarket and have no access to a vehicle or a significant number (at least 500 people) or share (at least 33%) of the population is greater than 1 mile from the nearest supermarket, supercenter, or large grocery store for an urban area or greater than 20 miles for a rural area, as classified by the latest United States Department of Agriculture Economic Research Service’s Food Access Research Atlas data set;

- An individual who has received Medicaid, Supplemental Security Income, Social Security Disability, and/or subsidized housing for at least 5 of the preceding 10 years; and/or,

- An individual who has resided for at least 5 of the preceding 10 years in a census tract in the top 15th percentile for the percent of residents in the census tract failing to graduate from High School in that state, as classified by the latest 5-year American Community Survey (Table S1501: Educational Attainment).

You can use this interactive map to determine if the location qualifies for any category of criteria A.

Criteria B (only 1 required);

- An individual who has been arrested for, convicted of, or adjudicated delinquent for any offense, or substantially similar offense, of Illinois, federal or other state law for:

- possession of not more than 500 grams of cannabis; or

- manufacture, delivery, or possession with intent to deliver, or manufacture of cannabis up to 30 grams;

- An individual who has a family member (i.e. a parent, legal guardian, child, spouse, or dependent) who has been arrested for, convicted of, or adjudicated delinquent for any offense, or substantially similar offense, of Illinois, federal, or other state law for:

- possession of not more than 500 grams of cannabis; or

- manufacture, delivery, or possession with intent to deliver, or manufacture or cannabis up to 30 grams.

- An individual who has been a victim of firearm injury. This must be evidenced by either a police report or medical record.

Still have questions? Contact our Illinois cannabis consultants to determine if you qualify for social equity. Now that we’ve discussed the laws and license application process, the last thing to cover is fees.

Fees

To enter the Illinois dispensary lottery, you must pay $250 for the application fee. This is a non-refundable fee.

Conclusion

If you want a cannabis business in Illinois, now is the time to apply for a license. The state plans to award many licenses within the next year. Work with our Illinois cannabis consulting firm to secure a high score on your application. We have the highest success rate in the industry and have already helped business entrepreneurs win plenty of licenses in Illinois.

Additional Information

Illinois Ownership Limitations

A single person or entity can not have a direct or indirect financial interest in more than 10 Conditional Adult-Use Dispensing Organization Licenses or Adult-Use Dispensing Organization Licenses.

Also, you are limited to three craft grow licenses.

Transferring licenses (selling and buying licenses)

In short, you are allowed to sell or transfer your Illinois cannabis business license. However, the IDFPR and DOA must approve your transfer of license application.